What is the Opportunity Passport?

The Jim Casey Youth Opportunities Initiative believes every young person leaving foster care should have the relationships, resources and opportunities to ensure well-being and success. The Jim Casey Initiative partners with sites across the country to create local, state and national policies and practices to realize this vision for all youth in foster care.

The Jim Casey Initiative also established the Opportunity Passport in 2001. Implemented for nearly two decades, with over 16,500 participants, it is a core intervention toward building young people’s financial capability.

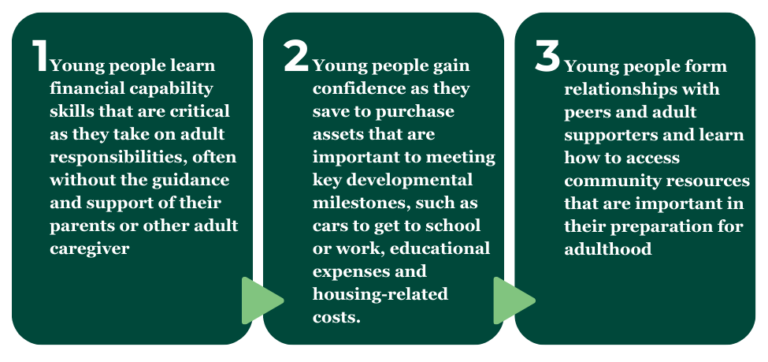

The program responds to insights from young people who said they lacked opportunities to learn about finances and practice financial decision-making while in foster care. The Opportunity Passport allows young people to learn the knowledge and skills needed to make important financial decisions, to gain experience with saving with financial institutions and to purchase assets that help them achieve long-term goals during their transition from foster care to adulthood.

The Opportunity Passport is designed for young people in or transitioning from foster care who are 14-26 years old and agree to complete a bi-annual survey to share information about their experience and outcomes.